Trump recently signed legislation that was

opposed by Military, Veterans, and consumer organizations, allowing Wells Fargo and other banks that engage in massive fraud to get away with cheating millions of customers, by imposing forced arbitration on them through "ripoff clauses" that are often hidden in the fine print. According to Pulitzer-Prize winning journalist Michael Hiltzik, of the Los Angeles Times,

"Here's why Wells Fargo forces its customers into arbitration: It wins most of the time."

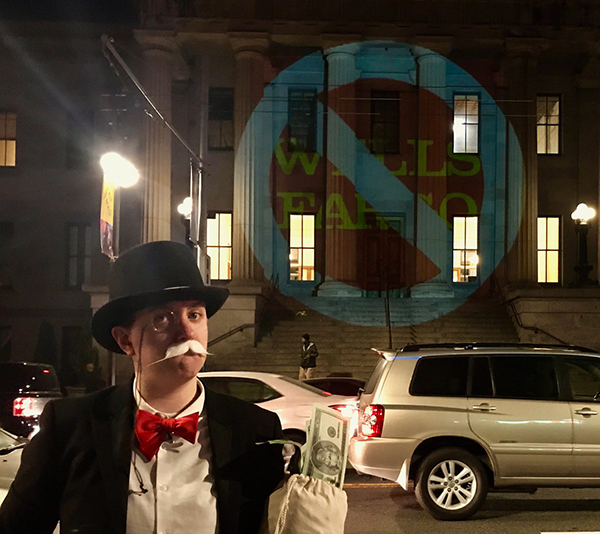

A couple days before Veteran's Day, military Veterans, relatives of Veterans, and supporters in Davis, CA protest against Wells Fargo. Bank managers called the police, who declined to arrest the peaceful protesters.

The protesters urged people and businesses with accounts at Wells Fargo to switch to credit unions, where typically there is no forced arbitration clause. Sacramento consumer Megan Varvais closed her accounts with Wells Fargo. She recently opened up new accounts at Golden One. CARS released the results of new research into the 131 California-chartered credit unions, which found that most credit unions in California do not take away their customer's rights to sue or to join a class action.

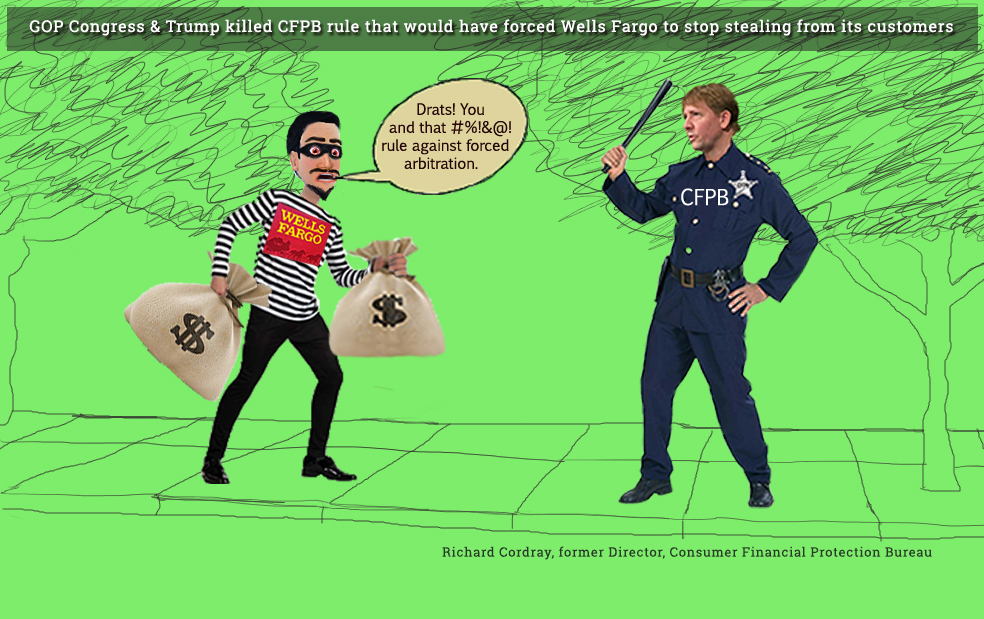

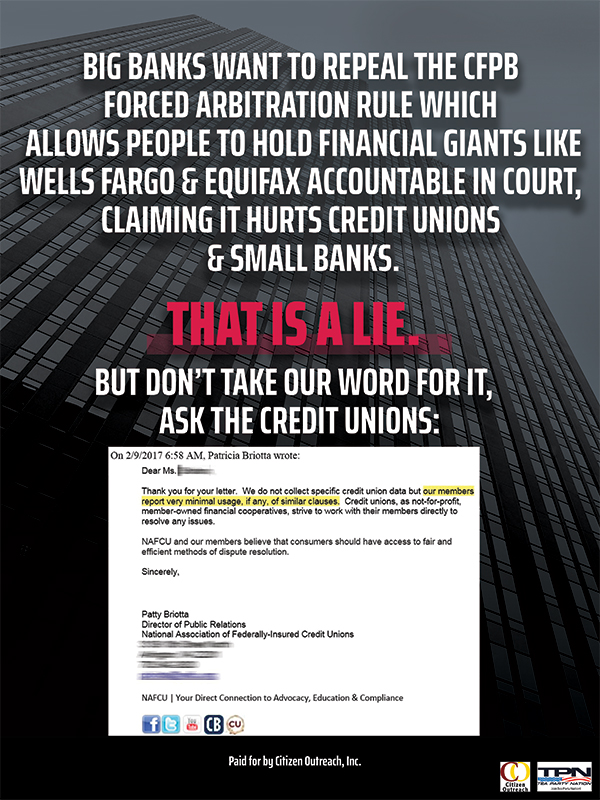

Wall Street and Wells Fargo made it a top priority to kill a rule issued by the Consumer Financial Protection Bureau that would have restored consumers' freedom to choose whether to band together and take banks that rip them off to court, or to pursue claims in private, corporate-controlled arbitration, a rigged system that consumers extremely rarely even attempt to use.

Wells Fargo and other Wall Street banks are currently celebrating a huge victory against being held accountable by their victims, thanks to GOP Members of Congress, who voted in the dark of night, and President Trump, who signed the anti-consumer, anti-military legislation into law behind closed doors, killing the CFPB rule. Congressman Garamendi and all other Democratic members of Congress voted to save the rule and consumers' Constitutional rights.

Among Wells Fargo's victims:

active duty military Servicemembers, whose vehicles Wells Fargo illegally repossessed, even when they had set up automatic payments before deploying to war zones. When military servicemembers experience financial readiness problems that harm their credit, such as vehicle repossessions, they may lose their security clearances, which can harm or even end their military careers. The loss of security clearances can pose a serious threat to our national security, as our nation desperately needs Servicemembers to be able to serve in the capacities they trained for, including in military intelligence, which requires high level security clearances.

A coalition of 29 military and veterans groups opposed the effort by Wells Fargo and other big Wells Street banks to overturn the consumer-friendly rule. The Military Coalition, which represents 5.5 million current and former servicemembers and their families, supported the Consumer Financial Protection Bureau's rule to free consumers to choose whether to take banks to court or to use private arbitration, calling forced arbitration an "un-American system wherein servicemembers are funneled into a rigged, secretive system."

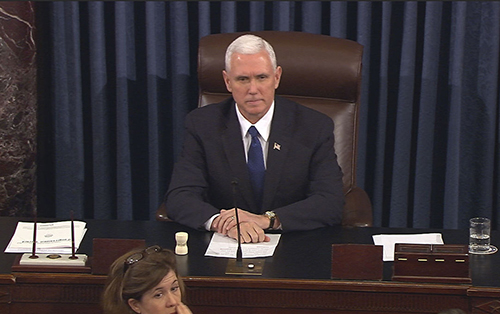

After all but 3 GOP members of Congress sided with Wells Fargo, Equifax, and other big banks, and voted to overturn the CFPB rule, with Vice President Pence casting the tie-breaking vote, the American Legion urged President Trump to veto the measure, stating in a news release:

"Every servicemember and veteran should have the right and responsibility to confront predatory loan practices….Many financial institutions include mandatory pre-dispute arbitration clauses in financial contracts that bar servicemembers, veterans and others from bringing legal action to court or banding together in class action lawsuits to seek relief under federal or state law. Class action waivers are particularly damaging to servicemembers, who may not be able to challenge a financial institution's illegal or unfair practices individually due to limited resources, frequent relocation or being deployed overseas."

1

The Consumer Financial Protection Bureau studied 419 class actions and found $2.7 billion in relief over five years for consumers, with just 18 percent going to attorney's fees and expenses. That is, $2.2 billion, or 82 percent, went to consumers — a far cry from a penny. When banks cheat millions of people out of $100 each, it takes lawyers on consumers' side to fight back and, yes, they get paid more than $100 if they win — but only if they win.

"It's shameful that our nation's Commander in Chief sided with Wall Street, and failed to honor the military community's veto request. Now it's our mission to show our military heroes and veterans that we have their backs, even if he doesn't," said Rosemary Shahan, President of the non-profit consumer advocacy organization Consumers for Auto Reliability and Safety, based in Sacramento. Shahan was married to a Navy Judge Advocate General officer for 20 years, and is the daughter and niece of veterans of World War II.

"I'm breaking up with Wells Fargo because President Trump took away our right to fight back in court if we are ripped off, and now it's up to all of us to protect ourselves by not doing business with dishonest banks. I refuse to do business with a bank that has a ripoff clause and imposes forced arbitration," said Sacramento consumer Megan Varvais. "It's also important to me to support our Military Servicemembers and Veterans, who deserve to have the freedom to choose to take a bank that ripped them off to court."

Varvais successfully sued JP Morgan Chase as a leading member of a class action that forced Chase to refund over $110 million in illegal overdraft fees to its customers, most of them struggling low-income consumers and their families. Chase also was compelled to reform its practices, benefiting future customers.

Wells Fargo is currently fighting against having to refund illegal overdraft fees to consumers in other states. (More information about Megan Varvais, Wells Fargo and overdraft fees is

posted here.)

Photo of Steve in uniform, circa 1986.

"I was proud to wear my country's uniform and serve in the United States Marine Corps. Today I'm also proud of our military and veterans associations, which have been standing up for our nation's Servicemembers and their families, and veterans, against crooked banks like Wells Fargo, to preserve our freedoms and fundamental Constitutional rights. It's shameful that our nation's Commander in Chief failed to honor the military community's veto request. Now it's up to us to send crooked banks a message: This fight isn't over. They won that battle, but we the people will win the war," said Steve Baumann of Woodland, CA, a Veteran who served in the U.S. Marines from 1986-1990.

"My wife is a veteran, and I couldn't be more proud of her and her service. Today we're sending a clear message that we're not going to let Wells Fargo and other crooked banks keep ripping off consumers, including our military heroes and veterans. Wall Street may have won in Congress, but we're going to win in the end," said Linda Deos, a consumer attorney and Davis resident who specializes in representing consumers in bankruptcy cases.

While some GOP Members of Congress have claimed that somehow forced arbitration is "better for consumers," those claims ring hollow, particularly since many of them voted to grant auto dealers a special exemption from the Federal Arbitration Act, restoring their right to sue auto manufacturers or anyone else they choose, in a court of law.

GOP Senator Chuck Grassley of Iowa, the leading proponent for giving car dealers that special exemption, is now the Chair of the U.S. Senate Judiciary Committee, and voted against restoring the same rights to consumers that Congress granted to car dealers. At the time, he argued on the Senate Floor:

"When mandatory binding arbitration is forced upon a party, for example when it is placed in a boiler-plate agreement, it deprives the weaker party the opportunity to elect another forum. As a proponent of arbitration I believe it is critical to ensure that the selection of arbitration is voluntary and fair. The purpose of arbitration is to reduce costly, time-consuming litigation, not to force a party to an adhesion contract to waive access to judicial or administrative forums for the pursuit of rights under State law….

This legislation will go a long way toward ensuring that parties [car dealers] will not be forced into binding arbitration and thereby lose important statutory rights. I am confident that given its many advantages arbitration will often be elected. But it is essential for public policy reasons and basic fairness that both parties to this type of contract have the freedom to make their own decisions [whether to sue or not] based on the circumstances of the case." -- Senator Chuck Grassley, (R-Iowa) Source: Statements on Introduced Bills and Joint Resolutions, United States Senate, June 29, 2001.

Video showing an active duty Army Sergeant, whose vehicle was illegally repossessed by Wells Fargo while he was serving in Iraq:

KSHB TV: Wells Fargo accused of unlawfully repossessing service member's car while deployed